Today Facebook announced it’s Cryptocurrency called Libra. The name was inspired by Roman weight measurements, the astrological sign for justice and the French word for freedom, said David Marcus, a former PayPal executive who is heading up the project.

“Freedom, justice and money, which is exactly what we’re trying to do here,” he said.

The digital coin will come online in the first half of 2020 if regulators in Switzerland, where the new currency is to be based, give the go-ahead.

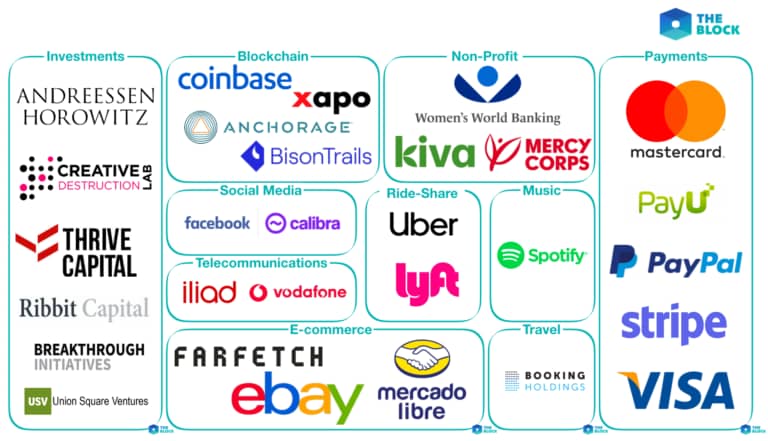

Facebook has created a management tool it has named Calibra, which will offer digital wallets to save, send and spend Libras.

The 27 partner companies in the project include household names such as Mastercard, Visa, Spotify, PayPal, eBay, Uber and Vodafone, as well as venture capital firms.

Facebook says it reached out to Goldman Sachs and JPMorgan to join but was unable to secure their interest.

Each partner company has invested at least $10 million into the project already. This is so because Enterprises who serve as validator nodes have to make an initial minimum investment of $10 million worth of Libra Investment Tokens and are expected to incur annual costs of approximately $280,000.

The white paper reads: “To ensure that Libra is truly open and always operates in the best interest of its users, our ambition is for the Libra network to become permissionless. The challenge is that as of today we do not believe that there is a proven solution that can deliver the scale, stability, and security needed to support billions of people and transactions across the globe through a permissionless network.”

CONCERN

Last year Facebook banned all bitcoin and other forms of Cryptocurrency advertisement on its platform, without any reason for doing so. Now it is clear!

Facebook’s platforms have about 2.7 billion users that’s the size of a continent. Adding Cryptocurrency to it, hmmmmmmm… makes Mark Zuckerberg the “king” of the biggest country in the world.

Facebook has mobilised some major actors in the fiat money system, actors that fought against cryptocurrency adoption, into its partnership. Who’s interest will they be protecting? What is clear here right now is the “lucrative business”.

Facebook Cryptocurrency system is a “permission” based system with 100 maximum validators, this is not a decentralised model. Over the years, what makes blockchain blockchain is it’s decentralised nature. But if Facebook says only 100 maximum, pre-determined minners would be able or have the sophistication enough to mine Libra, then that exposes the fundamental or default problem with Facebook, PRIVACY.